Saving for Retirement

Traditional IRA

A traditional IRA is any IRA that is not a Roth IRA or a SIMPLE IRA. You can set up a traditional IRA if you receive taxable compensation during the year. You can have a traditional IRA even if covered by an employer-sponsored retirement plan. However, the deductible amount of contributions to a traditional IRA may be phased out.

• Contribution limit. For 2021, contributions to IRAs are limited to the lesser of your compensation (or spouse’s compensation under a spousal IRA), or $6,000 ($7,000 age 50 or older).

• Spousal IRA. If both spouses have compensation, each can set up a separate IRA. Spouses cannot participate in the same IRA. If Married Filing Jointly, and one spouse’s compensation is less than the contribution limit, the lower-income spouse can use the compensation of the other spouse to qualify.

• SEP IRA. A SEP is a traditional IRA with different per year contribution limits. An employer (or self-employed individual) makes deductible contributions to a traditional IRA on behalf of the employee (or self-employed individual). Distributions are generally subject to the same rules that apply to traditional IRAs.

Prohibited Transactions Involving IRAs

Penalties apply when IRA funds are used in prohibited transactions. A prohibited transaction is any improper use of traditional IRA funds by the participant, the beneficiary, or a disqualified person. The following are examples of prohibited transactions.

• Borrowing money from an IRA.

• Selling property to an IRA.

• Receiving unreasonable compensation for managing an IRA.

• Using an IRA as security for a loan.

• Buying property for personal use (present or future) with IRA funds.

• Investing in collectables.

Roth IRA

A Roth IRA is subject to the same rules as a traditional IRA except for the following.

• Contributions are nondeductible. Thus, your participation in an employer plan is irrelevant.

• If certain requirements are satisfied, distributions are tax free.

• The required minimum distribution rules do not apply. Distributions are not required until your death.

• Contributions phase out for 2021 when modified adjusted gross income is $198,000 to $208,000 for Married Filing Jointly, $125,000 to $140,000 for Single and Head of Household tax filers, and $0 to $10,000 for Married Filing Separately (if spouses live together).

• Neither a SEP IRA nor a SIMPLE IRA can be set up as a Roth IRA.

SIMPLE IRAs

• Eligible employers. Employers can set up a SIMPLE IRA for employees if they have 100 or fewer employees who received $5,000 or more in compensation from the employer in the preceding year. The employer cannot maintain another qualified plan (except for certain union employees). The 100-employee limit must be met each year to continue contributing to the plan. A two-year grace period applies once this limit is exceeded.

• Eligible employees. Any employee who received at least $5,000 in compensation from the employer during any two years prior to the current year, and reasonably expects to receive at least $5,000 in compensation during the current year, is eligible to participate in the employer’s SIMPLE plan. The employer can offer the plan on a less restrictive basis but cannot make the plan participation rules any more restrictive.

Defined Contribution Plans

A defined contribution plan is a qualified plan that provides an individual account for each participant in the plan. Benefits depend upon the amount contributed, income, expenses, gains, losses, and forfeitures of other accounts that may be allocated to a participant’s account. Examples of defined contribution plans include profit-sharing plans, money purchase plans, 401(k) plans, and 403(b) plans.

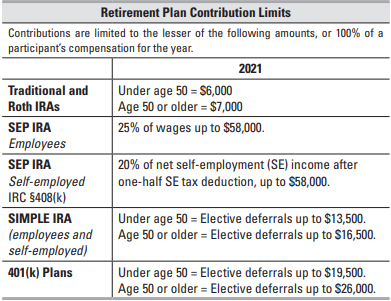

Retirement Plan Contribution Limits

Contributions are limited to the lesser of the following amounts, or 100% of a participant’s compensation for the year.

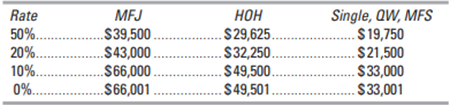

Retirement Savings Contribution Credit

The 2021 credit percentages are 10%–50% of eligible contributions to IRAs and retirement plans up to a maximum credit of $1,000 ($2,000 for Married Filing Jointly). Credit rates vary based on adjusted gross income.

The credit is not available if the taxpayer who made the qualified contributions:

• Was born after January 1, 2004,

• Is claimed as a dependent on someone else’s 2021 tax return, or

• Was a student during any part of five calendar months during 2021.

Eligible Contributions

Contributions and deferrals made for tax year 2021:

• Traditional and Roth IRA contributions.

• Elective deferrals to a 401(k), 403(b), governmental 457, or SEP.

• SIMPLE plan.

• Voluntary employee contributions to a qualified retirement plan as defined in IRC section 4974(c), including the Federal Thrift Savings Plan.

• Contributions to a 501(c)(18)(D) plan.

• Contributions to an ABLE account by a designated beneficiary.

Contribution amounts used to calculate the credit may need to be reduced by distributions received from any of the plans listed above after 2018, through the deadline for filing the 2021 return (including extensions).

Contact Us

There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves summarizing transactions and events that occurred during the prior year. In most situations, treatment is firmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you have questions about the tax effects of a transaction or event, including the following:

• Pension or IRA distributions.

• Significant change in income or deductions.

• Job change.

• Marriage.

• Attainment of age 59½ or 70½.

• Sale or purchase of a business.

• Sale or purchase of a residence or other real estate.

• Retirement.

• Notice from IRS or other revenue department.

• Divorce or separation.

• Self-employment.

• Charitable contributions of property in excess of $5,000.

For a printout version of this blog, click here.